Overall, Xero is an efficient and cost-effective way for small businesses to manage finances. Use the Xero accounting and bookkeeping app to create and send online invoices in seconds to help maintain a steady flow of cash into the business. You can use all Xero’s features, like invoicing, accepting payments and reporting, and add-ons like Xero Projects and Xero Expenses. Use the demo company to explore Xero’s features, or enter your own business details and data to try it out for real. Xero retains everything you’ve entered when you transfer from a free trial to a subscription. It allows three users for its Essentials plan ($55 per month) and 25 users for its top plan, the Advanced ($200 per month).

Xero Review 2024: Features, Pricing & More

This can be helpful if your company is growing fast, or you simply want the reassurance that there’s no limit llc capital contribution agreement to how many people can be part of the team. Keep in mind that the ability to use multiple currencies in the software and invoice is limited to the company’s highest tier, at $70 per month. If using multiple currencies is a priority to you, consider other platforms that offer this capability at a lower cost. Zoho, for example, is accounting software with a free invoice platform that allows you to bill in multiple currencies.

- If using multiple currencies is a priority to you, consider other platforms that offer this capability at a lower cost.

- Xero has pricing plans to suit your business, no matter its size or stage.

- QuickBooks is also better for businesses that need to track inventory, as it has built-in inventory management features.

- Xero’s bank reconciliation feature simplifies the process of tracking and reconciling your bank transactions.

- Xero provides multiple layers of protection for the personal and financial information you entrust to Xero accounting software.

- View the money coming in and out of your small business from the accounting app dashboard.

Accounting software

The Enterprise Desktop plan offered by QuickBooks starts at $1,922 per year. Run your small business from anywhere and remain productive in otherwise unproductive moments with the Xero bookkeeping and accounting app for small business. Check out the Xero App Store to find, demo, and buy business apps that connect to Xero. Apps like Stripe, GoCardless, Vend, and Shopify connect seamlessly and sync your data business valuation intellitips with Xero to make it easier to run your business. Xero’s bank feed securely imports your transactions into the Xero accounting software each business day.

Key features and functionalities of Xero:

Xero, FreshBooks and QuickBooks all offer 30-day free trials and extensive features for online support, including a live chat, email support and a knowledge base. All three of these offer the ability to scale their accounting for larger businesses and both Xero and QuickBooks offer specific training for accountants. These companies offer Gusto integration for the same price—$40 per month and $6 per month per person.

Today’s leading accounting platforms offer standard security features like data encryption, secure credential tokenization and more. While human error will always play some role in security breaches, you can be confident in your accounting platform when it comes to keeping your information safe. Another key difference between the two companies is the maximum number of users it allows. Xero has no limit to how many users can access data, whereas QuickBooks limits this to 40 with its Enterprise plan. Its lower-tiered plans require users to pay for their own plan. Xero and QuickBooks have similar pricing, except when it comes to QuickBooks Desktop.

Xero provides multiple layers of protection for the personal and financial information you entrust to Xero accounting software. Security is a priority for Xero, as we know it is for you, so it’s also important you also take steps to safeguard your data. Easily create and send invoices and automate invoice reminders for a quicker, hassle free payment. Use the accounting app to keep track of due and overdue invoices and whether they’ve been paid.

Is Xero Right for You or Your Business?

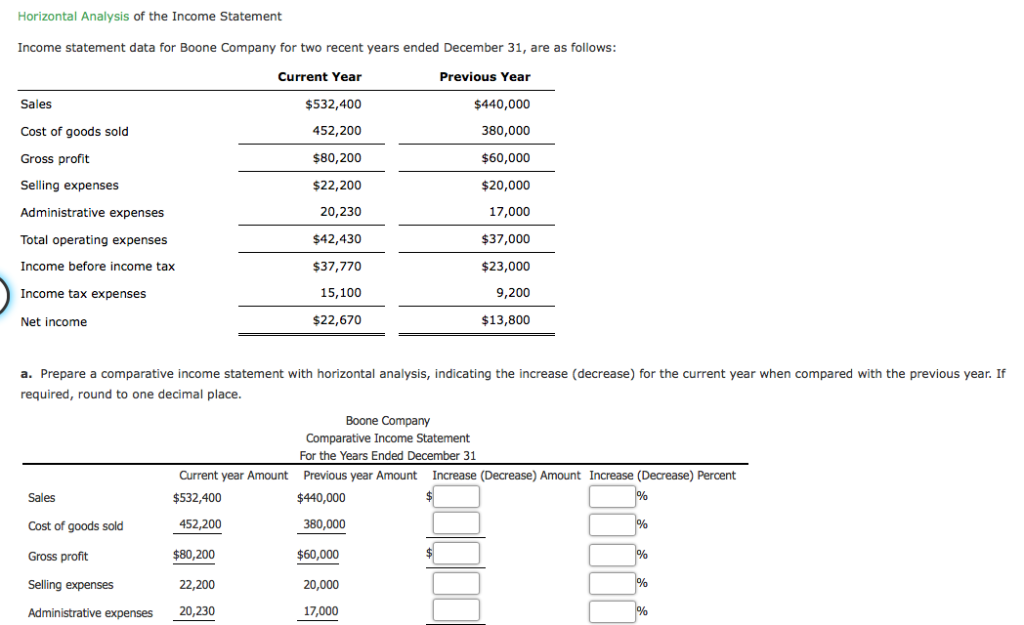

Given that there are several invoicing software on the market, it’s worth putting in some time to research your options before choosing one for your business. Get to know your finances with accurate, daily figures when you’re accounting online with Xero. View the money coming in and out of your small business from the accounting app dashboard. An accountant or bookkeeper can be useful set of hands to help with the accounting heavy lifting. Access Xero features for 30 days, then decide which plan best suits your business. If you find a cheaper all inclusive accounting solution similar to the ‘BOM Difference’, we will beat it by 10%.

Forbes Advisor compared Xero vs. QuickBooks when it comes to the key features, pricing, customer service and reviews to help you decide which is right for your business. Run your futures contract definition business from anywhere with Xero’s easy accounting app. Keep track of your unpaid and overdue invoices, bank account balances, profit and loss, cash flow and bills to pay. You can even reconcile bank accounts and convert quotes to invoices. It’s free with every subscription and compatible with iOS and Android. Plans start at $15 per month for up to 20 invoices, five bills, bank account reconciliation, receipt capture and short-term cash flow snapshots.