Research conducted by Davis and Lee in 2018 in the “Journal of Corporate Finance” revealed that firms that experienced a 15% increase in operational cash flow exhibited a significant reduction in debt dependency. Now that you know how to calculate percentage change, you can read about all the steps involved in horizontal analysis in the next section. We need to perform a horizontal analysis of the income statement of this company.

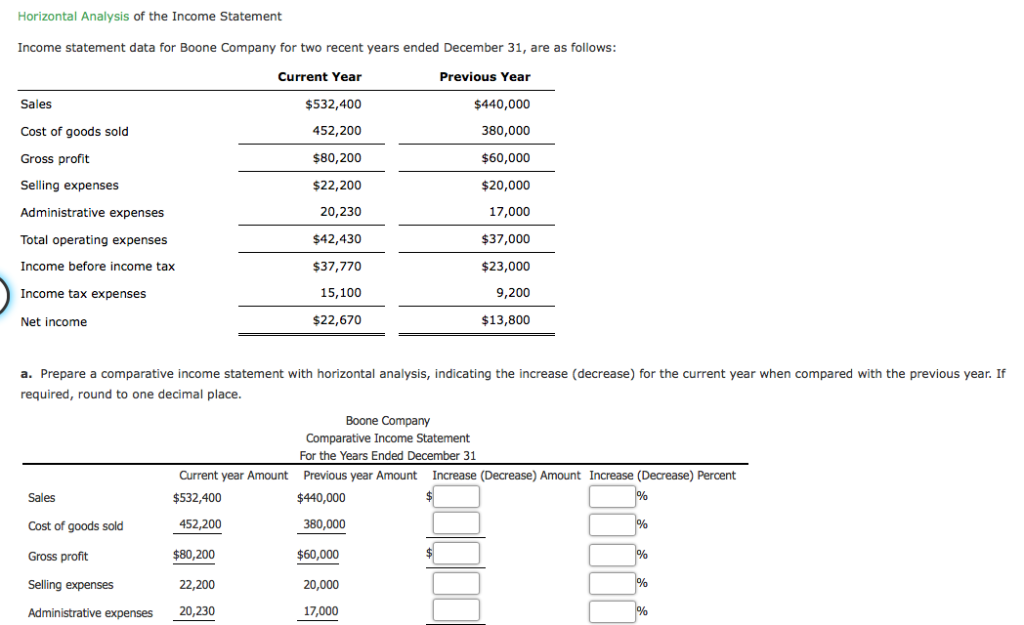

Horizontal Analysis using Income Statements

Drag down the cell with the formula to copy it to the other current assets line items. Drag down the cell with the formula to copy it to the other revenue line items, as turbotax freedom edition 2020 well as the total net revenue. If you work in finance or accounting and want to save time, avoid mistakes, and impress your boss, then you have come to the right place.

Example 5: Analyzing Non-Operating Income and Expenses

- The analysis compares line items from the same financial statement in different periods to identify whether there have been increases or decreases in the figures.

- For example, this analysis can be performed on revenues, cost of sales, expenses, assets, cash, equity and liabilities.

- An income statement is a vital tool in financial reporting and one of the most common and critical statements you’re likely to encounter.

- For example, we perform a horizontal analysis on the balance sheet of Wipro, an Indian information technology company.

Additionally, the financial statements to be provided need to be respective statements for the accounting periods to be compared. At least two of these statements are compared, but having and comparing three or more statements makes horizontal analysis easier, more accurate, and reliable. Likewise, the following is a horizontal analysis of a firm’s 2018 and 2019 balance sheets. Again, the amount and percentage differences for each line are listed in the final two columns and can be used to target areas of interest.

Collect Financial Statements

For example, in the case of the income statement, each line item might be calculated as a percentage of the revenue line. In this example the business is looking for trends over the three years from 2019 to 2021. By producing the horizontal analysis it is possible to monitor changes in each line item over time. For example, clearly the revenue is growing each year, however, the expenses, particularly the sales and marketing expenses are growing more rapidly, resulting in a reduction in the net income and net income % of the business. Just like the above comparative balance sheet, these balances obtained from income statements are collected from different periods; 2020 as the base year and 2021 as the comparison year. Other financial statements are also considered during Horizontal Analysis but these two statements are generally sufficient enough to provide appropriate insights into a company’s financial health.

If you are an investor considering investing in a company, only a year-end balance sheet or income statement would not be enough to judge how a company is doing. Better yet, you can see many years of balance sheets and income statements and compare them. Horizontal analysis is an approach used to analyze financial statements by comparing specific financial information for a certain accounting period with information from other periods. With different bits of calculated information now embedded into the financial statements, it’s time to analyze the results. The identification of trends and patterns is driven by asking specific, guided questions. For example, upper management may ask “how well did each geographical region manage COGS over the past four quarters?”.

In this discussion and analysis of operations, Safeway’s management noted that the increase was due to a growing trend toward mortgage financing. In percentage comparison, the increase or decrease in amounts is expressed as a percentage of the amount in the base year. This insights and his love for researching SaaS products enables him to provide in-depth, fact-based software reviews to enable software buyers make better decisions.

Horizontal analysis typically shows the changes from the base period in dollar and percentage. For example, a statement that says revenues have increased by 10% this past quarter is based on horizontal analysis. The percentage change is calculated by first dividing the dollar change between the comparison year and the base year by the line item value in the base year, then multiplying the quotient by 100. A manufacturing company’s EBIT (Earnings Before Interest and Taxes) has declined despite an increase in revenue.

Financial statement analysis presents you with your firm’s liquidity, debt, and profitability, emerging problems, and strengths. All these are taken into account in relation to identifying your past financial performance and your prospects for the future. Financial analysis of an income statement can reveal that the costs of goods sold are falling, or that sales have been improving, while return on equity is rising. Income statements are also carefully reviewed when a business wants to cut spending or determine strategies for growth. These “buckets” may be further divided into individual line items, depending on a company’s policy and the granularity of its income statement. For example, revenue is often split out by product line or company division, while expenses may be broken down into procurement costs, wages, rent, and interest paid on debt.