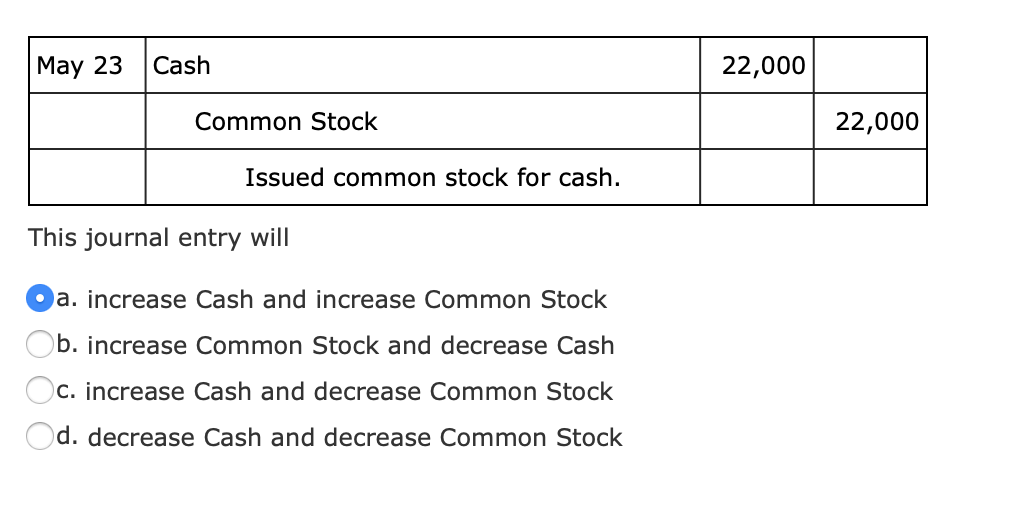

In most circumstances, common stock is the only type of equity instrument that companies may issue. The number of issued shares is simply the quantity that has been sold or otherwise conveyed to owners. Kellogg reports that one billion shares of common stock were authorized by the state of Delaware but only about 419 million have actually been issued to stockholders as of the balance sheet date. The remaining unissued shares are still available if the company needs to raise money by selling additional capital stock. The company can make the journal entry for the issuance of common stock for cash at par value by debiting the cash account and crediting the common stock account. When a corporation issues common stock at par value, the amount of cash or non-cash assets received equal to the value of the common stock.

Retire of Treasury Stock

- The rights of the holders of common stock shares are normally set by state law but include voting for a board of directors to oversee current operations and future plans.

- Common Share par value is the legal value state in the company article of memorandum.

- Par Value or Face Value or nominal value is the value state on the share or bond.

- We also now have to start dealing with the premium or the additional capital above par.

The difference between issuance price and par value is recorded as Additional Paid-In Capital. Each share of common or preferred capital stock either has a par value or lacks one. The corporation’s charter determines the par value printed on the stock certificates issued.

Issuing Stock for Noncash Assets

The number of issued shares that are still circulating in the open market are referred to as outstanding. Shares issued is the number of shares a corporation has sold to stockholders for the first time. The number of shares issued cannot exceed the number of shares authorized. Even though the company is purchasing stock, there is no assetrecognized for the purchase. Immediately after the purchase, the equitysection of the balance sheet (Figure14.6) will show the total cost of the treasury shares as adeduction from total stockholders’ equity.

Journal entry for issuing common stock for service

Management may decide to retire treasury stock in balance sheet. The company is able to sell the stock back at a higher price when it buyback. So the company needs to record more additional paid-in-capital into the balance sheet. The common stockholders are the owner of the company and they have the right to vote for the company director, board, and request for change in the management team.

But small businesses often have more flexible arrangements to raise capital. The company usually sets an authorized share higher than their current need. The company spends $ 5.5 million to purchase the shares and keep them on the balance sheet. The company will be liable to the shareholders in case of the market price fall below par value. The common stock can be issued with par value and without par value. Traditionally, companies have gotten around this limitation by setting the par value at an extremely low number2.

As mentioned, the share capital account will only include the par value of the shares. The excess amount of $50,000 ($150,000 – $100,000) ended up on the share premium account. The debit side will include the full amount of the finance received. As mentioned, this account disputing an invoice will only hold the par value for the shares issued by the company. For companies, the process of separating the amount is crucial in determining the amount for this account. Even when companies don’t receive compensation, they must credit the par value to this account.

The common stock, sometimes, is issued for non-cash assets; for example in exchange for land or building, or sometimes in exchange for not paying organization expenses to the promoters. Such non-cash assets are then recorded at the market values as of the date of transactions. The no-par value stock refers to the common stock that has no par value.

This is another equity component which need to record on the balance sheet. 2Many other laws have been passed over the years that have been much more effective at protecting both creditors and stockholders. In our final example, we are going to look at the use of the constructive retirement method. It is typical for this method to be used to retire the shares as they are repurchased, rather than moving those shares into Treasury Stock initially. ABC Ltd, the company we always use in our examples, is an SME working in the American mid-west as a small construction, project management and landscaping business.

This time Preferred Stock and Paid-in Capital in Excess of Par – Preferred Stock are credited instead of the accounts for common stock. When the company issues the common stock to the investors, an accountant has to record equity on the balance sheet. The equity components will be separated into two parts which are the common stock and additional paid-in capital. Stock can be issued in exchange for cash, property, or servicesprovided to the corporation.

However, the legal capital of the DeWitt Corporation is $200,000. Because we have worked through a lot of the detail you would be expected to know in the cash example; we will keep this example much simpler. And one reason for this is often these types of transactions don’t involve the application, allotment and call process that you would see in an offering of shares for cash. Now we are into the exciting part of the article, the journal entries. I always say if you don’t like the debits and credits, you shouldn’t be an accountant.