The panelists pointed to the EU’s initiatives with its AI Act to regulate AI and create a legal framework that balances innovation and consumer protection. The complexity of AI systems necessitates a broad approach, with debates around specific prohibitions and national sovereignty in AI regulation, they stated. Concerns were raised also about the broad scope of the AI Act, potentially leading to conflicts with existing laws and creating operational challenges for businesses. However, safe harbors and technical standards could offer “green zones” for compliant operations, the panelists noted. Wealthblock.AI is a SaaS platform that streamlines the process of finding investors. It helps businesses raise capital and handle automated marketing and messaging and uses blockchain to check investor referral and suitability.

GenAI can even help prepare first drafts of 10-Qs and 10-Ks, including footnotes and management discussion and analysis (MD&A). With the increasing complexity of regulatory compliance around the globe, the cost and resource burden of regulatory reporting has soared in recent years. Organizations devote significant time and resources to meeting those requirements.

- The integration of artificial intelligence in the financial domain offers substantial efficiency gains and enhanced client services.

- AI also presents regulatory challenges in that the centralizing tendency of AI contrasts with decentralized financial trends like cryptocurrencies.

- Generic advice and guidance is ok as a starting point, but it can only take you so far when looking to make decisions about your finances.

- They can also have difficulty going deep enough on a single gen AI project to achieve a significant breakthrough.

- When cash is tight, they can reassess loan positions or trigger foreign exchange transfers between subsidiaries.

Science, technology and innovation

The market value of AI in finance was estimated to be $9.45 billion in 2021 and is expected to grow 16.5 percent by 2030. Business units that do their own thing on gen AI run the risk of lacking the knowledge and best practices that can come from a more centralized approach. They can also have difficulty going deep enough on a single gen AI project to achieve a significant breakthrough. Learn wny embracing AI and digital innovation at scale has become imperative for banks to stay competitive. Explore the free O’Reilly ebook to learn how to get started with Presto, the open source SQL engine for data analytics.

Scaling gen AI in banking: Choosing the best operating model

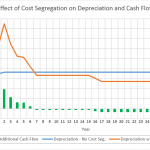

Another revolutionary application is AI-assisted liquidity management, enabling precise forecasting of cash positions, essential for operational stability and strategic planning. These innovations show that AI’s role extends beyond task automation, providing insights that can alter fundamental business strategies and market interactions, the panelists noted. Affirm offers a variety of fintech solutions that include savings accounts, virtual credit cards, installment loans and interest-free payments. It aims to equip businesses and consumers with the tools necessary to purchase goods and services. Without the right gen AI operating model in place, it is tough to incorporate enough structure and move quickly enough how to calculate gross profit margin to generate enterprise-wide impact.

Overall, the integration of AI in finance is creating a new era of data-driven decision-making, efficiency, security and customer experience in the financial sector. The Deloitte AI Institute helps organizations transform through cutting-edge AI insights and innovation by bringing together the brightest minds in AI services. 2023 was a game-changing year for business, with an explosion of interest in generative artificial intelligence. 2024 is the year to experiment, prove value, and begin adoption of AI in finance. GenAI can be used to produce narrative reports, providing context into the numbers by combining financial statements and data with an explanation of each.

Recent Artificial Intelligence Articles

AI is transforming the finance industry, bringing new levels of efficiency, personalization, and monitoring. By streamlining operations, enhancing the customer experience, and mitigating risks and fraud, AI is helping the industry navigate an increasingly complex and dynamic landscape. By analyzing a wider range of data points, including social media activity and spending patterns, AI general ledger can provide a more accurate assessment of a customer’s creditworthiness. This enables lenders to have a more holistic picture of the individual to make better-informed decisions, reducing the risk of defaults as well as extending credit to folks who might not otherwise qualify with traditional measures.

To choose the operating model that works best, financial institutions need to address some important points, such as setting expectations for the gen AI team’s role and embedding flexibility into the model so it can adapt over time. That flexibility pertains to not only high-level organizational aspects of the operating model but also specific components such as funding. For a preview, look to the finance industry which has been incorporating data avoiding unnecessary cause marketing signage and algorithms for a long time, and which is always a canary in the coal mine for new technology. The experience of finance suggests that AI will transform some industries (sometimes very quickly) and that it will especially benefit larger players.

With its ability to process vast amounts of data and quickly produce novel content, generative AI holds a promise for progressive disruptions we cannot yet anticipate. Task automation is an obvious cost reduction tactic, letting companies decrease their labor costs, fill workforce gaps, improve productivity and efficiency, and have employees focus on strategic, value-adding activities. Companies also say that better insights and decision-making facilitated by AI is key to decreasing costs. Organizations using AI may be better able to optimize inventory levels and supply chains, detect fraud, identify cost-saving opportunities, and allocate resources more effectively.